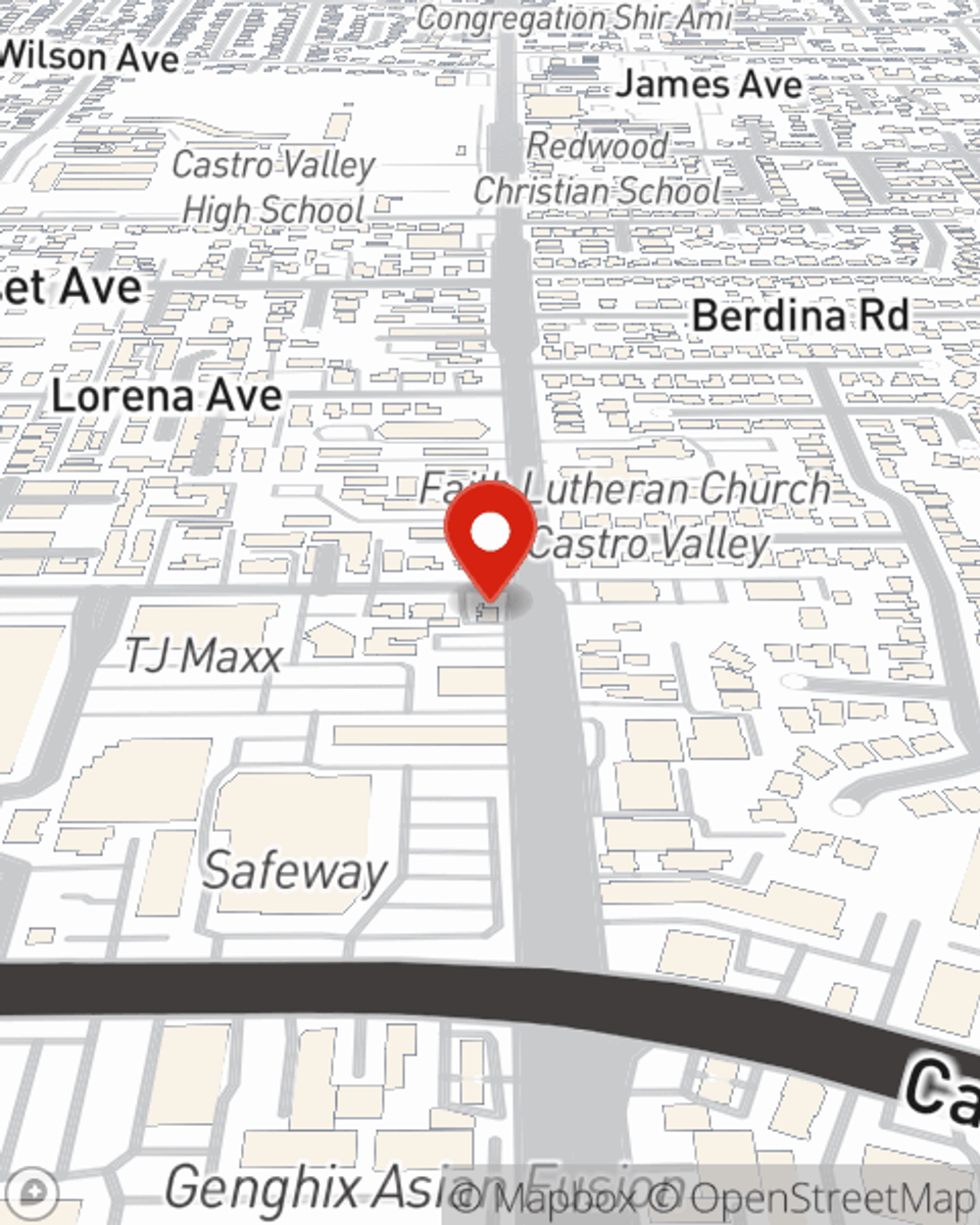

Life Insurance in and around Castro Valley

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Castro Valley

- Hayward

- San Leandro

- San Lorenzo

- Ashland

- Cherryland

- Oakland

- Alameda County

- East Bay Area

Be There For Your Loved Ones

When facing the loss of your spouse or your partner, grief can be overwhelming. Regular day-to-day life halts as you prepare for funeral services arrange for burial, and come to grips with a new normal devoid of the one who has died.

Insurance that helps life's moments move on

Life happens. Don't wait.

Love Well With Life Insurance

Having the right life insurance coverage can help loss be a bit less stressful for your loved ones and allow time to grieve. It can also help cover bills and other expenses like college tuition, utility bills and future savings.

Don’t let fears about your future keep you up at night. Contact State Farm Agent Todd Anglin today and learn more about how you can rest easy with State Farm life insurance.

Have More Questions About Life Insurance?

Call Todd at (510) 537-8100 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Todd Anglin

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.